Equipment (Machine) Rental

In addition to cylinders, TrackAbout can track rental of individual pieces of equipment, such as welding machines or portable life-form scanners. Unlike cylinders, which are rented in aggregate, equipment is typically rented individually (like a car).

Equipment Rental works best when only individual, uniquely tracked assets (i.e. scanned assets) are rented. While you can rent Not-Scanned Assets using the Equipment Rental method, it is not recommended.

How Equipment Rental Works

Equipment rent is based on how long the equipment’s been held by the customer, with the customer being charged the lowest of three set rates (day, week, or month).

TrackAbout determines what rent to charge by calculating the number of days the equipment has been held since it was delivered or last billed.

For Equipment Rental calculation purposes, a day is a twenty-four hour period that begins at the time of day the equipment was last delivered, including weekends and holidays. If the equipment was returned five minutes or less than the start time of that day, the day is not counted.

Examples

-

Monday 10 am to Mon 10:05 am = No Rent (Within 5 minute minimum)

-

Monday 10 am to Mon 10:06 am = 1 day

-

Monday 10 am to Tues 10:00 am = 1 day

-

Monday 10 am to Tues 10:01 am = 2 days

-

Monday 10 am to Tues 1 pm = 2 days

Weeks are seven consecutive days. Months are 28 days by default, but can be set to 30 or 31 days upon request. Both Weeks and Months are not rounded up for calculation purposes.

TrackAbout then takes the total number of days and calculates what the rent would be under each Rental Rate.

Daily Rate x Number of Days Held

Weekly Rate x (Number of Days Held / 7)

Monthly Rate x (Number of Days Held / 28)

Finally, the rent is set to the lowest of the three calculated values.

Overrides

Special Rates

-

Special rental rates can be set during one deliver/return cycle for a unique asset.

Example: A special price of $10 a day for asset #123.

This special price is only for this asset and it goes away when this asset is returned.

-

Rates may also be set as Standard Rates, Bracketed Rates, Customer Rates, and Customer Rates for a specific Department (Ship-To).

Overriding Delivery and Return Date

-

The start/end date of rental can be different than the actual deliver/return date of the asset.

The returns case is common: End customer calls and says "I'm done with it, come pick it up. Oh, you can't pick it up for a few days... well can you stop the rent today?"

-

The override of the delivery date happens on the delivery record.

-

The override of the return date also happens on the delivery record. In this way all overrides are all in the same place.

-

There is a special permission for creating/changing/removing these rental date overrides. There is an audit entry on the delivery any time that the rental date override is added, changed or removed.

Purchase Order

-

The PO (Purchase Order Number) shown on the rental bill is the PO from the delivery of the asset to the customer. Be sure this is set correctly on the delivery.

Flat Fees

-

Flat fees are extra charges added to a rental bill.

-

Flat fees can be added to equipment assets on the delivery record to the customer.

NOTE

The flat fee must be assigned to an asset on the delivery record — the fee will not appear on the rental bills unless it has been assigned to the asset on the delivery record.

-

There are three kinds of flat fees for equipment:

Equipment, Recurring Charge — These are billed on every rental bill that the customer gets for this asset, including the first bill and the last bill.

Equipment, Delivery Charge — This kind of flat fee is only charged on the first rental bill for the asset.

Equipment, Return Charge — This kind of flat fee is only charged on the final rental bill for the asset, after the asset has been returned.

-

Flat Fees can’t be negative numbers.

-

In the original Flat Fee setup, each kind of flat fee can be set to "Accrue Revenue to Asset". This means that the charges will be applied to the running rental revenue accrued to the asset.

-

It is possible to override the standard price for a flat fee. This is done on the delivery record.

-

It is possible to override the description text shown on the rental bill for each flat fee. This is done on the delivery record.

-

On the Rental bill we do not aggregate similar flat fees for different assets, but instead show each flat fee on its own line.

Rental Equipment Description

-

There is a Rental Description field on each asset. This field is shown on the rental bill for this asset.

Generating Bills

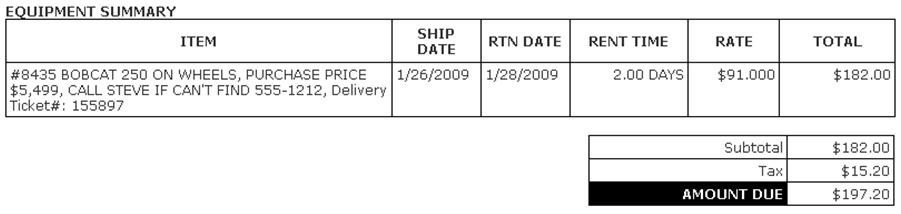

Rental Bill Example

Here is an example of the main section of an equipment rental bill:

The "Item" column shows the following information about the asset.

-

The serial number of the asset.

#8435in the example. (The "#" is shown by default. It is not part of the serial number.) -

Asset Type's description.

BOBCAT 250 ON WHEELSin the example. -

Rental description of the asset.

PURCHASE PRICE $5,499, CALL STEVE IF CAN'T FIND 555-1212in the example. -

The record this asset was delivered on.

Delivery Ticket#: 155897in the example.

Creating Rental Bills

Rental equipment bills are generated in one of two ways:

-

Generating a bill on the return record for a piece of equipment. This can be used to create a bill when a customer returns a piece of equipment and wants their rental bill generated on the spot so that they can pay for the equipment before they leave. See Special Bill Generation: Equipment Rental for step by step instructions.

-

Periodically generating bills for all outstanding equipment at customer sites or returned but not yet billed. This is normally done monthly or weekly, but can be done on any schedule.

Billing Frequency

-

Bills may be generated at any time.

-

The system does not enforce that bills must be generated every week or month or any other such schedule.

-

Any billing that was not completed already is searched for and billed in the current rental run.

Options

Contact TrackAbout Support to enable or disable any of the following options.

Assign Equipment Rental Rates during Delivery — False by default. If set to true, the current equipment rental rates will be assigned to assets during delivery. The assigned rates will not change when the standard rates applicable to the customer are changed.

Bills Equipments in Advance? — By default, billing periods end are generated for the end of a billing period. When set to true, bills are generated at the start of the billing period.

Combine Replacement Asset Line Items? — If enabled, when an asset is replaced with another asset, the two line items are combined together into a single line item. A replacement is said to take place when an asset is returned and another asset of the same asset type is delivered on the same day.

Days in Month for Equipment Rental — The number of days in a month used for Equipment Rental Calculation. Default is 28.

Generate Separate Bill For Each Delivery? — When set to true, a separate bill is generated for each delivery record that originally delivered the equipment. In this mode, a customer can have multiple equipment bills in a billing period. When set to false, a single bill is generated for all equipment rentals in the billing period.

Hold if Returned Equipment Not Inspected — When set to true, Equipment Rental Bills are put into a held state if any asset in the bill has been returned but has not yet been inspected.

Include All Assets on Balance for Equipment Rental — When set to True, all Rental Equipment on a customer's balance at the end of the rental billing period are included in the bill. When set to False, only Rental Equipment that are on balance for more than a month are billed. Assets that have been returned during the billing period are always billed irrespective of this setting.

Use Effective Start Date as Displayed Start Date — When set to True, the earliest date that any asset in the equipment bill is being billed for is displayed as the start date of the rental period in the generated bill. If set to False, the start date of the billing period is displayed as the start date.

Setup

TrackAbout will create a rental billing period type for you for Equipment Rental.

TrackAbout will load some new asset attributes into the system that are used by Equipment Rental. You can see these by looking at the asset history of any asset and clicking to Edit Properties.

-

Purchase Date

-

Purchase Price

-

Rental Equipment Description

-

Rental Equipment Manufacturer S/N

-

Rental Equipment Accrued Rental Before TrackAbout

-

Rental Equipment Last Bill Date Before TrackAbout

You will want to create an "Equipment Rental" Rental Class. Check that the Accounting Code is set to what you want it to be set to.

You can then assign assets to the new Equipment Rental rental class. This will change how they are handled and rented.

Other Features

Accrued Rental

TrackAbout can track all of the rental accrued for each piece of equipment.

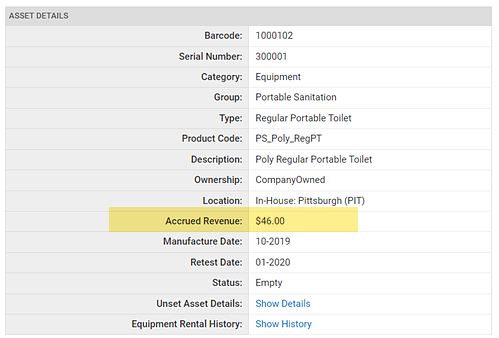

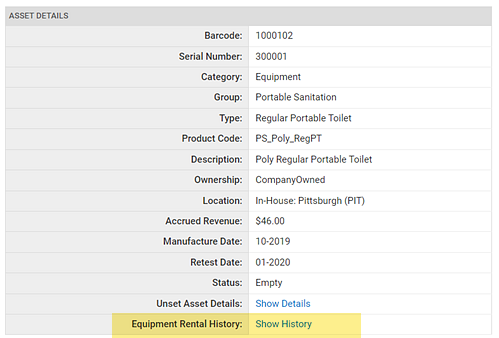

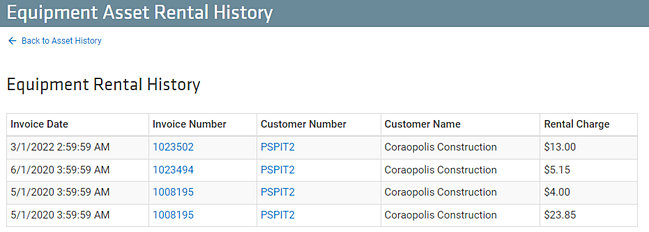

Viewing Accrued Rental -

For every piece of Equipment there will be a link on the Asset History > Asset Details page called Equipment Rental History

A full history of a given asset's rental revenue can be seen and linked back to how much revenue came from each rental invoice.

-

This accrued rental does not include tax.

-

This accrued rental does include flat fees if those flat fees have the property checked to 'accrue revenue to asset'

Include Legacy Data

If you have collected accrued rental data for your equipment prior to joining TrackAbout, this information can be loaded into the system and added to total accrual calculated by TrackAbout. This legacy information is called Rental Revenue Accrued to Asset before TrackAbout.

When in use, the Rental Revenue Accrued to Asset before TrackAbout will be added to the accrued rental captured through TrackAbout and the total amount will display on the Asset's Detail page under Accrued Rental